Installments [Egypt]

Bank Installments allow customers to use their credit cards for purchasing products and services online via e-commerce websites or offline at stores, and pay for them over time through a set number of scheduled payments.

Merchants receive the full amount of the order (minus fees) upon purchase. The collection and management of each installment payment from the customer are handled by the banks.

Supported Banks:

- Bank Misr

- Abu Dhabi Islamic Bank

- Arab Investment Bank

- Mashreq Bank

- Emirates NBD

- National Bank of Kuwait

- National Bank of Egypt

How it works?

Banks issue specific ranges of BINs (Bank Identification Numbers) for credit cards that support installments. Each bank offering installment options to its customers has installment programs that customers can choose from when making a payment for a product or service.

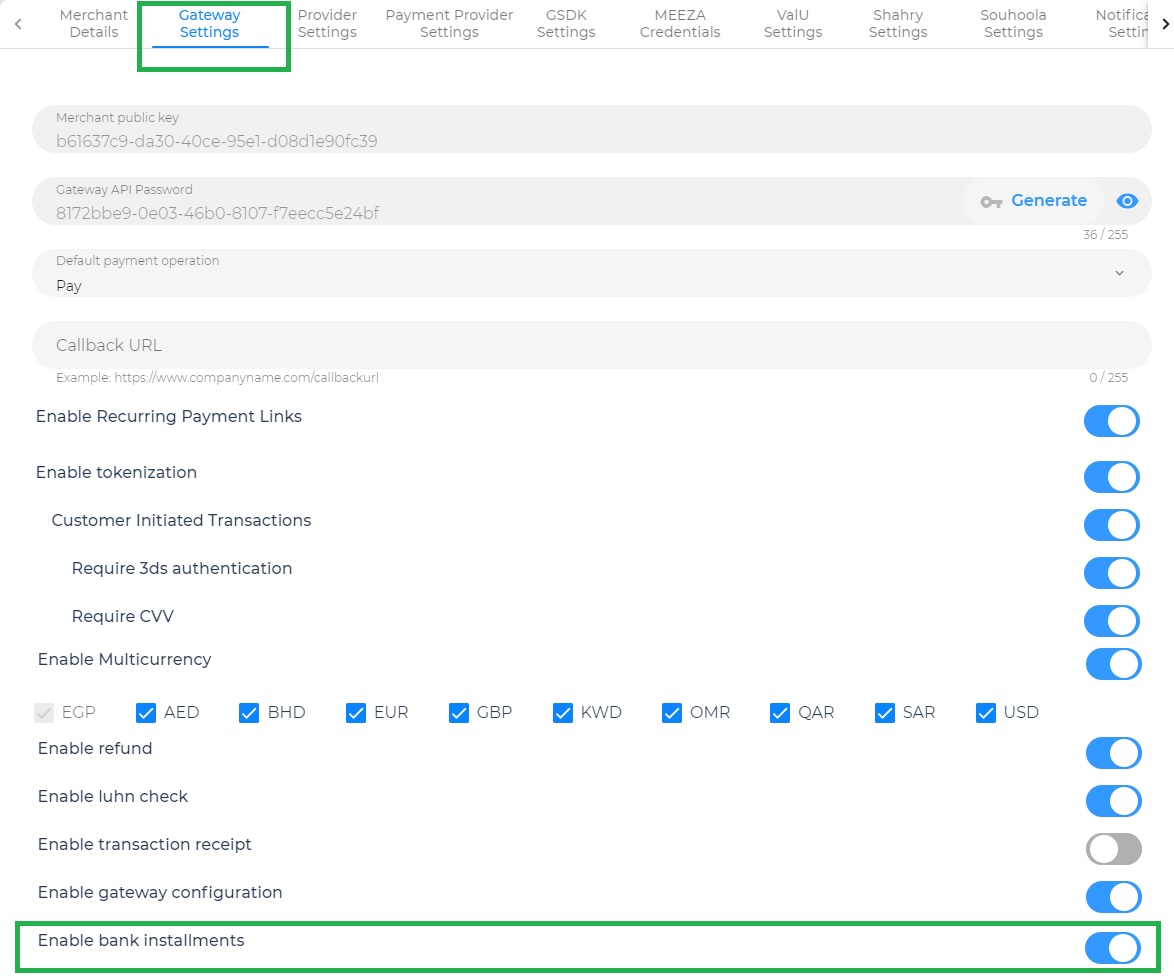

Enabling installment feature and Set-up of installment plans:

The installment feature needs to be enabled for a merchant in the gateway settings. Please refer image below:

The installment service is like a central hub where we keep track of information about banks that provide installment options. This includes details about the installment plans offered by each bank and the specific cards that are eligible for these plans (identified by bin ranges).

You as a merchant can contact Geidea account manager to know about the available banks installment plan and choose the suitable plan for you and your customers, and after that the operation team will enable this plan and bank installment feature for you.

Customer Journey

There are 4 different user journeys that are possible.

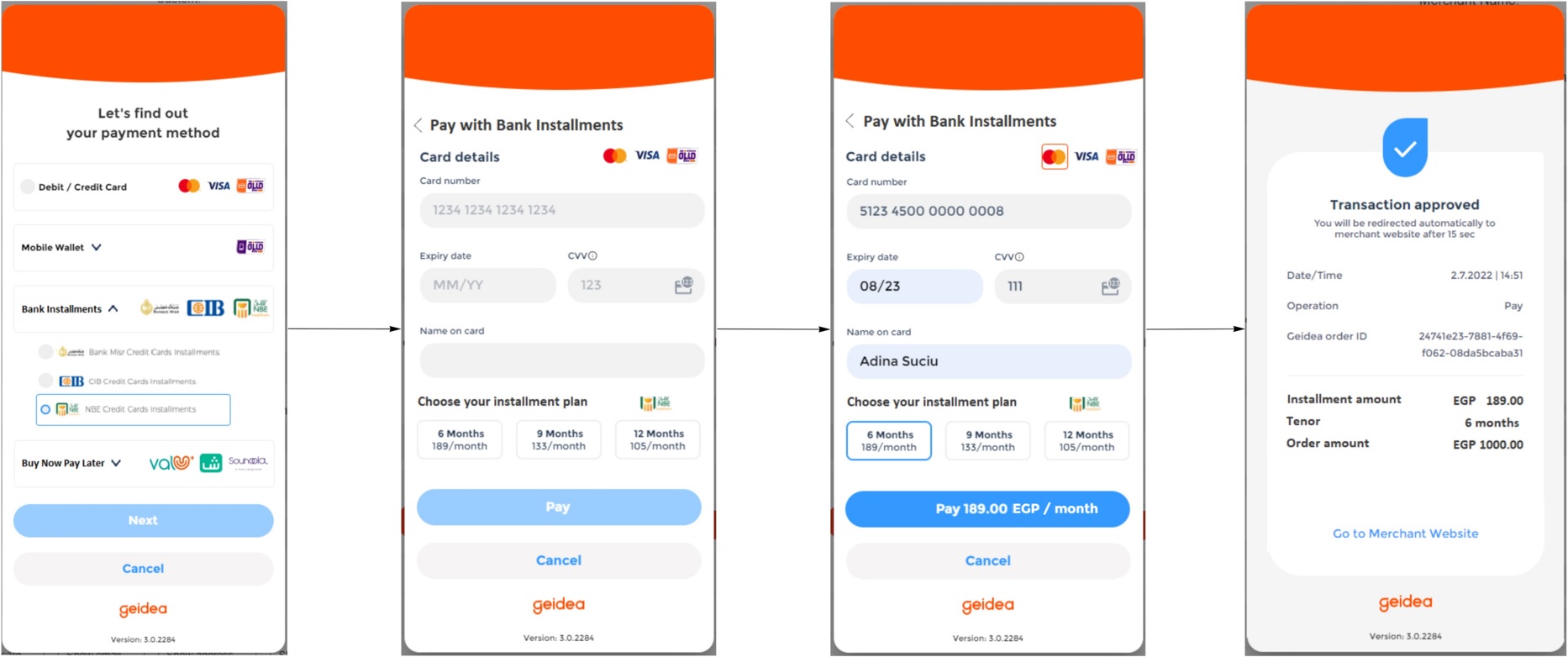

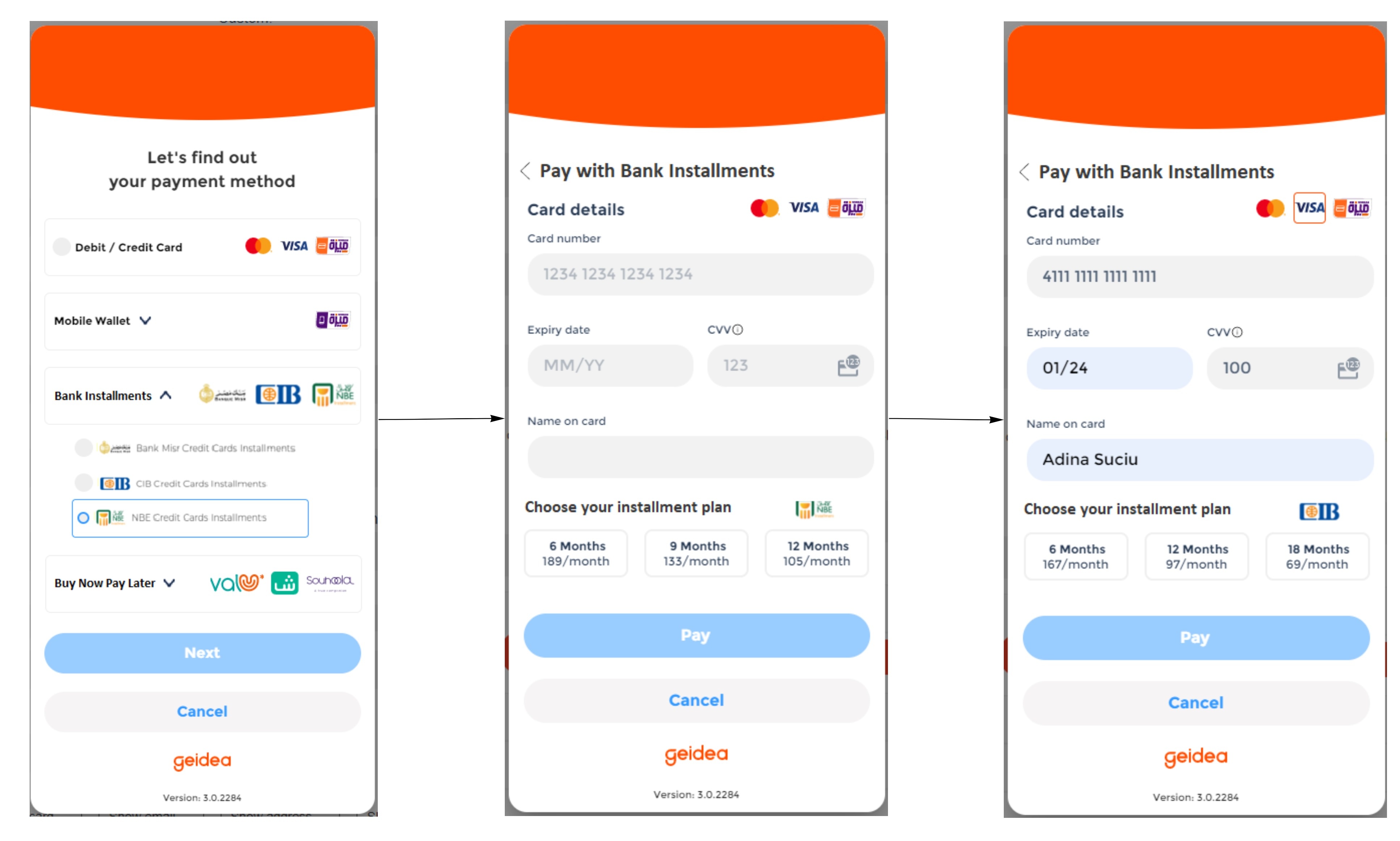

1.Use case - 1: Customer selects 'Bank Installments' payment method for a specific bank and uses a card that supports installments:

- Step-1: Payment method selection screen: Select Bank Installments → eg: NBE Credit card Installments and click 'Next'.

- Step-2: Pay with Bank Installments screen: View available installment plans for NBE (NBE logo is shown along with the card logos and installment plans).

- Step-3: Pay with Bank Installments screen: Input card details for a valid NBE credit card that accepts installments.

- Step-4: Pay with Bank Installments screen: Select installment plan and proceed with the payment using bank installments.

- Step-5: Transaction receipt screen: View details related to the installment plan selected for the purchase.

Refer image below:

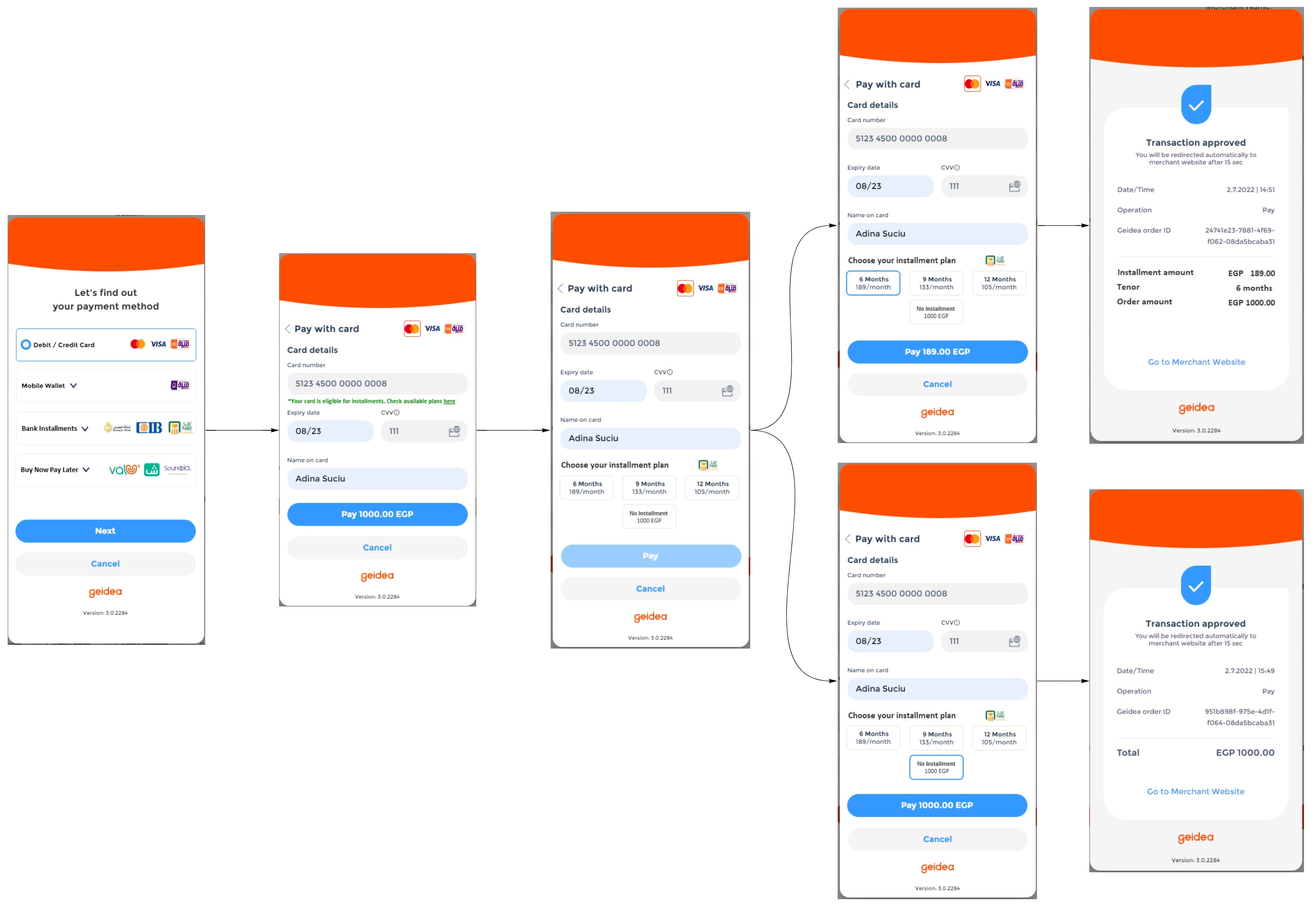

2.Use case - 2: Customer selects normal 'Card' payment method and uses a card that supports installments.

- Step-1: Payment method selection screen: Select 'card' payment method and click 'Next'.

- Step-2: Pay with card screen: Input card details for a valid NBE credit card that accepts installments. On click out, the GW recognizes that the card accepts installments and shows a message below the card number field 'Your card is eligible for installments. Check available plans here'.

- Step-3: Pay with card screen: On click on the 'here' link, the bank logo and the available installment plans are shown. The Customer has the possibility to:

- Select an installment plan and pay for the purchase in monthly bank installments

Select no installment and pay for the purchase through a normal card payment

- Select an installment plan and pay for the purchase in monthly bank installments

- Step-4: Transaction receipt screen: View details related to:

- the installment plan selected for the purchase, in case an installment plan has been selected.

- the normal card payment transaction, in case no installment plan has been selected.

Refer image below:

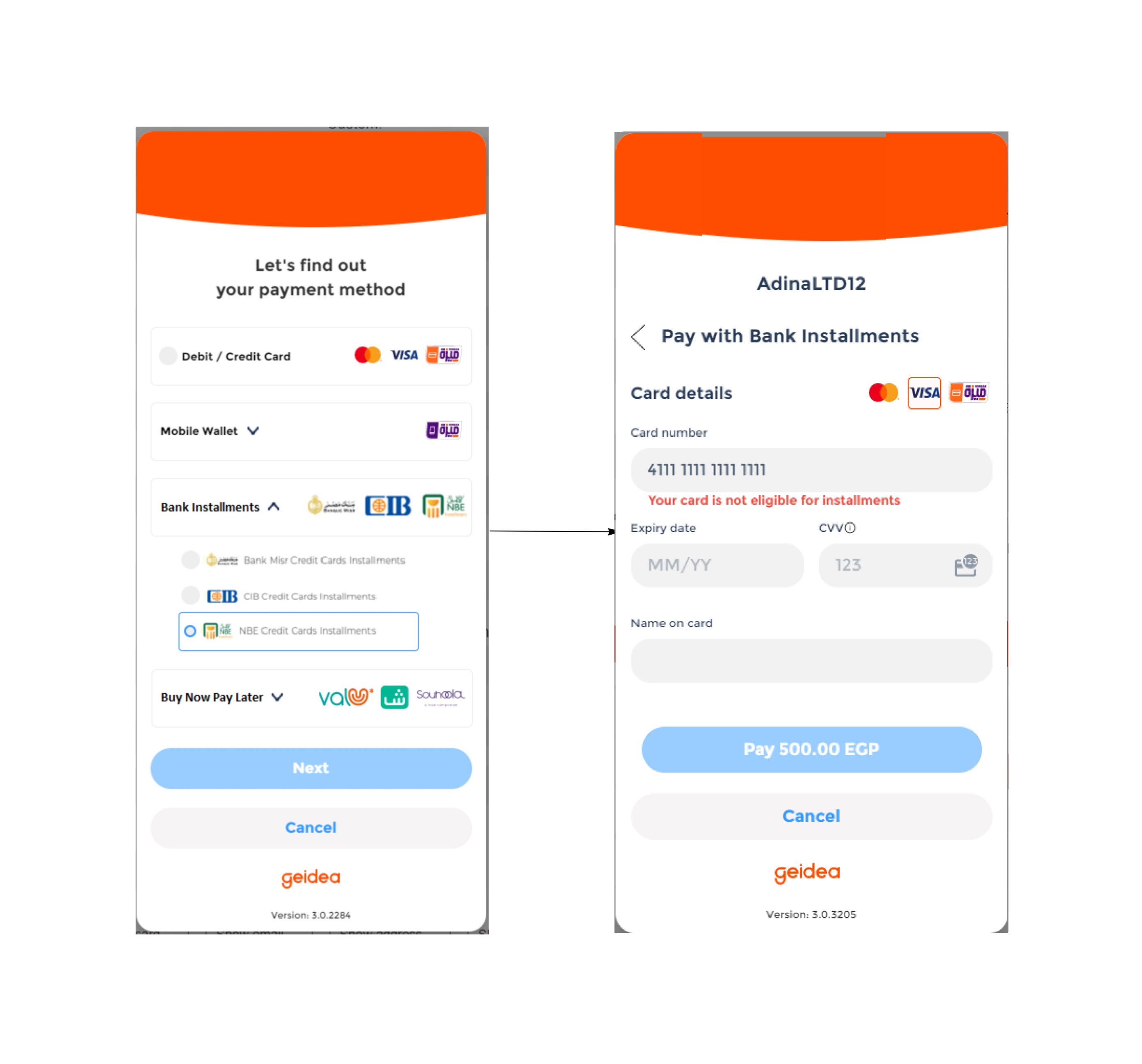

3.Use case - 3: Customer selects 'Bank Installments' payment method for a specific bank and a card that does not support installments.

- Step-1: Payment method selection screen: Select Bank Installments → NBE Credit card Installments and click 'Next'.

- Step-2: Pay with Bank Installments screen: View available installment plans for NBE (NBE logo is shown along with the card logos and installment plans).

- Step-3: Pay with Bank Installments screen: Input card details for a card that does not accept installments. On click out, the GW recognizes that the card does not accept installments and shows a message below the card number field "Your card is not eligible for installments"

- Step-4: Pay with Bank Installments screen: The Customer either tries to input another card, either goes back to the payment method selection screen and selects a different payment method.

Refer image below:

4.Use case - 4: Customer selects 'Bank Installments' payment method for a specific bank and uses a card that supports installments but for a different bank.

- Step-1: Payment method selection screen: Select Bank Installments → NBE Credit card Installments and click 'Next'.

- Step-2: Pay with Bank Installments screen: View available installment plans for NBE (NBE logo is shown along with the card logos and installment plans).

- Step-3: Pay with Bank Installments screen: Input card details for a credit card that supports installments but is issued by a different bank, e.g. CIB. On click out, the GW recognizes that the card accept installments issued by CIB and not NBE, therefore refreshes the installment plans section with the CIB installments and logo.

- Step-4: The Customer continues with the payment normally, by selecting an installment plan and confirming the payment.

Refer image below:

Reporting

At the end of each day (and once a month), the banks that provide installment options receive a report for every installment transaction processed through the payment gateway. Each bank receives a single report specifically tailored to them, summarizing all the installments handled during that time. This helps ensure transparency and clear communication between the banks and the payment gateway.

Updated 9 months ago